indiana real estate tax lookup

About Clark County Tax Sales. To lookup the sales tax due on any purchase use our Indiana sales tax calculator.

Should I Hire A Real Estate Agent To Sell My House Sell My House Real Estate Things To Sell

Exemption A protection or exclusion on a portion of property taxes.

. Taxes and Real Estate. The first step in obtaining your license is to complete 75 hours of state-approved pre-licensing education and pass the final exam of your course with a 75 or. Invest in real estate and never run out of money.

Long-term mortgage interest rates continued their move to record highs for 2015 according to data from mortgage finance company Freddie Mac. A tax roll year refers to the fiscal tax year. The median real estate tax payment in the county is just 1147 per year which is slightly lower than the state average.

You need a salesperson license to sell real estate in Missouri. In the United States a sheriff is an official in a county or independent city responsible for keeping the peace and enforcing the law. Sex and Real Estate.

Read on to learn about the eight steps youll need to complete before starting your career in Louisiana real estate. When looking for an assessed value keep in mind that the assessed value for a particular year for instance 2015 is the value upon which taxes are based in the following year ie. Indiana Code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the County Treasurer.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. A real estate sale or purchase is a fairly rare occurrence in any individuals life so you will need to have an extensive network of contacts in order to continuously generate new business. Fiscal Tax YearTax Roll Year A fiscal tax year runs from July 1 through June 30.

Taxes can be divided into two annual installments with one being due on May 10 and the other on November 10. Missouri Real Estate Agent License. Which makes crystal clear the importance of learning how to get escrow business directly you can go from making 6000 to over 9000 just by learning to get business from a different source.

Unlike most officials in law enforcement in the United States sheriffs are usually elected although some states have laws requiring certain law enforcement qualifications of candidatesElected sheriffs are accountable directly to the citizens of their. He will speak wisdom to you. In other words for the tax bill you received and paid in 2016 the assessed value is listed as the 2015 assessed value.

The owner of record is determined by who owned the property as of January 1st of the previous year. Hotel Room Rental Tax. See Out-of-State Applicants for further information.

Liens on your property can prevent you from getting a loan or selling your property. Buy Rehab Rent Refinance Repeat is the five-part BRRRR real estate investing strategy that makes financial freedom more attainable than ever. And the formal dining room with real copper ceiling tiles.

Listing by Pinkham Real Estate Nella Thompson. You also have to take the 24-hour Missouri Real Estate Practice Course. Real Estate and Personal Property taxes are due on May 10 2022 and November 10 2022.

Out-of-state applicants must also submit a completed and notarized Consent to Service of Process RE 234. This lets us find the. In order to be eligible for real estate licensure in the state of Indiana you must be 18 years or older and obtain a high school diploma or the equivalent.

Real Estate ABC - Information on Buying and Selling A Home Interest Rate Report - Jul 2015. To learn about how much it costs to get your real estate license visit our Louisiana Pre-Licensing pricing page. Real estate owners in the state of Indiana must pay taxes on their property every year.

Begin the process by completing 48 hours of pre-licensing education. Evidence of completion of Real Estate Principles Real Estate Practice and one additional course from the course requirements list must be on file before your license is issued. Act 77 Senior Tax Relief Program.

Sexual Harassment Sexual Discrimination and Fair Housing Approval 70481 Course Details. BingoSmall Game of Chance. The Hoosier State dropped its flat income tax a smidge in 2017 from 33 to 323 but many counties in Indiana also impose their own income taxes with an average levy of 156 according to the.

Indianas sales tax rates for commonly exempted items are as follows. The Indiana sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the IN state tax. Currently 28 states allow for the transfer or assignment of delinquent real estate tax liens to the private sector according to the National Tax Lien Association a.

What You Need to Know Approval 70484 Course Details. Real estate investors can rely on exhaustive property information and real estate records aggregated from multiple public sources and enhanced with proprietary research. Tax Collection Dates.

The treasurer collects real personal and mobile home property taxes. 2021 payable 2022 tax statements will be mailed April 13 2022. Indiana Real Estate License.

God wants you under the. Local and School District Tax Millage. Getting your Louisiana real estate license might seem daunting but were here to guide you through the process.

Boats and real estate sales may also vary by jurisdiction. The Treasurer maintains debt service accounts for bonded indebtedness of the County. This is especially true when it comes to economic issues including investment real estate interest rates inflationary pressures government.

If you have a mechanics lien on your property or are about to have repairs done you may benefit from professional advice. Live Your Life To Please God. A statement with the breakdown of credits debits and payments for the buyer and the seller at the closing of a real estate transaction.

You must then take the Missouri salesperson exam and pass both sections. Formally known as The Crags it is the remaining piece of a once larger 500-acre summer estate and continues to offer privacy and seclusion yet. Save time and repetitive manual labor with property records that cover all asset types from residential to commercial including office and industrial buildings on one platform.

You have to develop the habit of listening to God. How to live your life to please Him. Bartlett New Hampshire Verenigde Staten.

104 GRAND SUMMIT RD. An involuntary lien is typically placed on a property due to unpaid obligations like a tax bill or a home improvement invoice which is sometimes. A local real estate and construction law attorney will be able to ease your concerns and protect your interests.

Learn More opens in a new tab Demo Videos opens in a new tab Register for Webinars opens in a new tab Like us on Facebook opens in a new tab. And if you learn how to get business directly from escrow officers mortgage officers and real estate agents you can give yourself a 50 raise. If youve been a prolific real estate agent and often find yourself helping other agents youll likely be a good fit for starting a brokerage.

506 6 Th St Indiana Real Estate Real Estate New Homes

Refm Real Estate Financial Modeling Ultimate Guide W Templates

48 South Crowell Street Indiana Real Estate Real Estate New Homes

The 40 Most Profitable Locations For Traditional Rentals In 2021 Cash On Cash Return Mashviso Indiana Real Estate Missouri Real Estate California Real Estate

6860 North Gray Road Indiana Real Estate Built In Dresser Real Estate

Cedar Gables Canexel Siding Cultured Stone Cedar Decking Custom Home Builders Home Builders Custom Homes

A Rental Property Finder Business In Toronto Can Be A Sound And Profitable Venture So Careful Management Is Required T House Prices Real Estate Housing Market

Real Estate Private Equity Career Guide

Real Estate Has Witnessed A Slowdown In Year 2017 This Decrease In Prices Is Not Only Because Of One Reason But There Are Property Prices Real Estate Estates

What To Do When You Get A Tax Bill For A Home You No Longer Own The Washington Post

525 South Oakwood Drive Real Estate Indiana Real Estate New Homes

Pennsylvania Property Tax H R Block

742 Watch Hill Ln Anderson Twp Oh Mls 1500681 Property Search House Search Real Estate

2022 Property Taxes By State Report Propertyshark

Property Tax How To Calculate Local Considerations

Check Out This Home I Found On Realtor Com Follow Realtor Com On Pinterest Https Pinterest Com Realtordotcom House Prices Building A House Moline

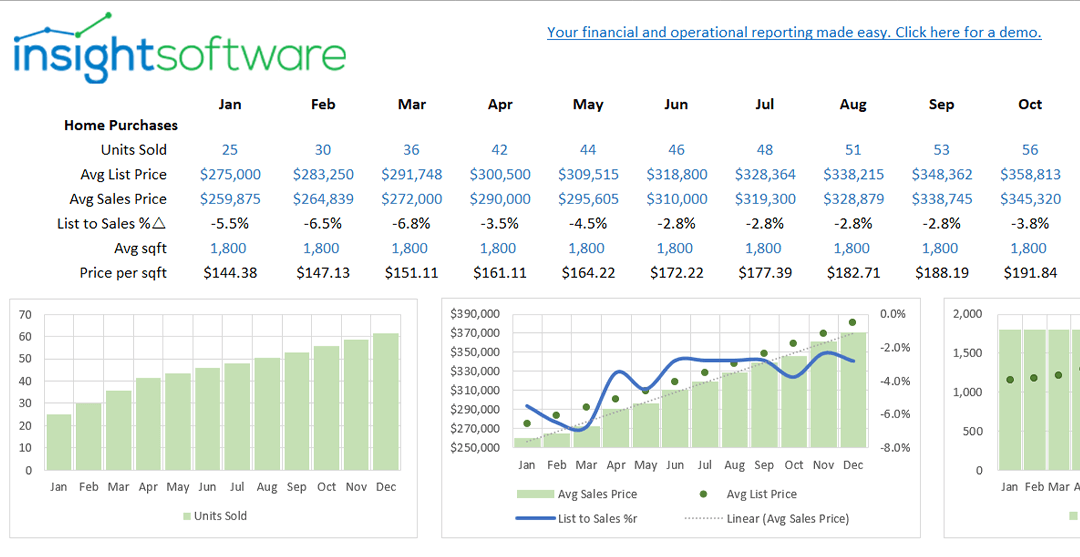

Top 22 Real Estate Kpis And Metrics For 2021 Reporting Insightsoftware

1264 Ironwood Drive Real Estate House Styles Real Estate Listings