working in nyc taxes

Even with this NJ state tax usually comes out to be less than NY state tax in most cases. Your pay for working in NY is fully taxable by NY.

Create The Perfect Design By Customizing Easy To Use Templates In Minutes Easily Convert Your Image De Income Tax Preparation Tax Services Accounting Services

As a nonresident you only pay tax on New York source income which includes earnings from work performed in New York State and income from real property located in the state.

. If you work in NY and live in NJ taxes usually require filing paperwork with both states. By living outside the city you save about 3-35 in nyc locality tax. There are four tax brackets starting at 3078 on taxable income.

How Your New York Paycheck Works. First the good news. 1 Best answer.

They usually pay taxes based on the months lived in each state eg three months of taxes to the first state nine months to the second. The rate varies from 3078 percent to a top marginal rate of 3876 percent as of the 2019 tax year. Taxpayers in New York City have to pay local income taxes in addition to state taxes.

Basically that is what happens. Remote Workers May Owe New York Income Tax Even If They Havent Set Foot in the State By Jennifer Prendamano James Jay M. Cigarettes are subject to an excise tax of 435 per pack of 20 and other tobacco products have a tax equaling 75 of the wholesale price.

Taxes are challenging and with the 2018 Tax Bill they might get much trickier for small businesses. New York Tobacco Tax. An accountant can help keep you in compliance with tax laws by calculating payroll taxes for the employees of yours or even keeping up with sales tax changes.

You may also owe money to both states. After all this is a land of pros and cons. For instance the average New Yorker works 49 hours a week thanks to.

Statutory residents can find themselves in a real bind. Wait a minute. New York s strict convenience of the employer test is intended to protect New York s apportionment system by prohibiting nonresidents who commute to jobs in New York from avoiding New York taxes on income that is derived from New York sources because they choose to work part of the time at home.

This means that if you live in one state and work in another only one state can tax you. Answer 1 of 10. Live in NJ Work in NYC.

The New York state tax starts at 4 and goes as high as 882 while in New Jersey rates start at 14 though they go as high as 118 if you make more than 5000000. This guide will go over all you need to know from where youll file to the most significant benefit of living in New Jersey avoiding the city income tax. An accountant can keep you updated with changes as well as tax laws.

When you start a job in the Empire State. The New York State Department of Taxation and Finance has posted an announcement regarding the extension of the deadline to file personal income tax returns for tax year 2020. In New York City there is an additional 150 excise tax per pack of cigarettes.

New York Property Tax. You pay out of state income taxes to the State of NY on portion of income earned in New York imagine if you were a professional baseball player and all the state tax returns youd have to. For example if you live in New Jersey but work in New York you may have two 2 box 16 amounts one for New York and one for New Jersey and the New Jersey amount may contain income that is actually taxable to New York.

You pay state and federal taxes in the State of PA on total income. In addition to the state deductions and exemptions you also may be eligible for the New York City household. Most New York City employees living outside of the 5 boroughs hired on or after.

Property taxes are due either in two semi-annual payments for homes with assessed values of more than 250000 or four quarterly payments for homes with assessed values of 250000 or less. Make sure that you are not charged for New York City income tax and that you get a refund when you file New York taxes if you do end up paying such a tax erroneously. Youre also responsible for city income tax if you live in NYC and work in NJ.

And when it comes to navigating work culture things arent always much easier. June 4 2019 130 PM. But there are subtleties.

If you are going to live in NJ and work in NYC youre probably wondering how youll be paying taxes. The short answer is. If you are a nonresident you are not liable for New York City personal income tax but may be subject to Yonkers nonresident earning tax if your income is sourced to.

In fact the one for New Jersey may even be slightly higher than the one for New York. You will owe little or no tax to NJ because you will get a credit on your NJ tax return for a large portion of the tax that you pay to NY. October 1 2021 The onset of the COVID-19 pandemic in March 2020 coupled with the rise in New York individual income tax rates that became effective in April 2021 spurred many individuals to move out of New York and.

Hello - I live in CT but work in NYC. Tax withholding is required. New York City offers several exemptions and property tax reductions including exemptions for senior citizens veterans and the disabled.

Congress passed a law in 2015 that forbids double taxation. For other taxpayers just working a full-time job for a company could count towards being a statutory resident of that companys state. NY and NJ state taxes are a wash.

This is a question youre probably asking if you live in NJ and work in NYC. Youll save city taxes if you live in NJ or outside the five boroughs. On the other hand many products face higher rates or additional charges.

One advantage to living in New Jersey while working for a New York Citybased company is you wont be subject to any NYC taxes as those city taxes are only relevant to taxpayers who reside in NYC for all or part of the year notes Engel. NYC Personal Income Tax. NY will tax you only on money made in NY CT will tax you on income you earn worldwide but give you a credit for tax paid to other states.

Non-resident Employees of the City of New York - Form 1127. In this article well talk about the myth of the New Jersey double tax and what you need to know if you are worried about getting taxed twice if you live in New Jersey and work out of state. However depending on where you live and your circumstances Ive found you may have to pay 250-450 for a monthly train pass into the city to commute.

Like the states tax system NYCs local tax rates are progressive and based on income level and filing status. Since you work in NY you should be having NY tax withheld from your paycheck and not NJ tax. Taxes will be slightly easier if you live in NY but not much.

Since NYCs city tax rate is over three percent thats a significant saving. You may still have to pay income tax to more than one state but you cant be taxed twice on the same money. City taxes are not huge but they add up 3 ish.

Did I get double taxed.

Dcarsoncpa On Taxes Economic Research Screenwriting Financial

What Do Successful Entrepreneurs Have In Common Entrepreneur Success Tax Accountant Accounting Firms

Cpa For Freelancers And The Self Employed In Nyc Small Business Cpa Manhattan Cpa Self Employed Nyc Cpa William Income Tax Income Tax Return Tax Services

Tax Service Provider Company Blockchain Accounting Firm In The Usa Hcllp In 2021 Tax Services Business Tax Professional Accounting

3 Reasons Working With An Accountant Is Smart Business Tax Accountant Smart Business Cpa

Pin On Nyc Co Op Board Application

What A Fashion Editor S Salary Can Get You In Nyc Fashion Editor Fashion Editor

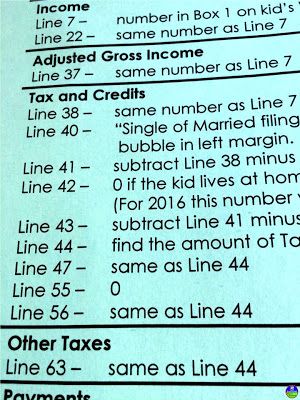

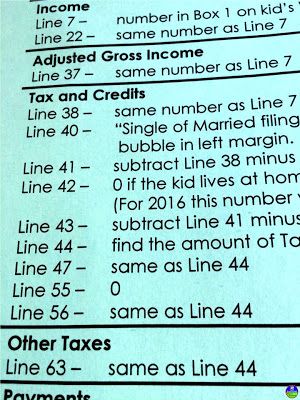

1040 Income Tax Cheat Sheet For Kids Consumer Math Income Tax Financial Literacy

Buying An Apartment J51 Tax Abatement Hauseit Buying A Condo Property Tax Home Buying

Tax Accountants Irs Enrolled Agents Tax Accountant Enrolled Agent Filing Taxes

We Are Here To Help You Tax Payroll Accountacy Vat Pahrirl Tax Preparation Tax Services Tax Deductions

Tax Company Tax Prep Ad Instagram Image Accounting Services Corporate Tax Services

Use Our Tax Calculators And Find Great Information About Taxes Estate Tax Property Tax Tax Deductions

Wedding Photographer In New York City Michael Patricia The Day Before They Wed New York Photographer Wedding Photographers

Investment Income Is Money Earned By Your Financial Assets Or Accounts And Understanding How It Works Can Help Maximize Your Profits Capital Gain Capital Gains Tax Dividend

What A Fashion Editor S Salary Can Get You In Nyc Fashion Editor Career In Fashion Designing Salary

Small Biz Owner You Need Turbotax Self Employed Turbotax Filing Taxes Finances Money

It Is Most Remarkable Accountancy Firm In Terms Of Service Accountability Affordability Productivity Accuracy Accounting Services Accounting Tax Accountant